“Stocks at record highs despite uncertain geopolitical landscape”

“Shares plunge as coronavirus outbreak renews investor fears”

“Markets enter correction territory after worst loss since GFC”

You would have seen these headlines or similar over the last few weeks. It’s evident that investment markets are on edge. We’ve experienced an unprecedented bull run on the Australian Securities Exchange (ASX), bolstered by low interest rates and now, investors and commentators alike are naturally questioning if this rally is at an end given the emerging economic impacts of the COVID-19 virus.

The virus outbreak is certainly having a dramatic impact as it hits different regions of the world.

So what do you do when market volatility increases, share values begin to tumble and rise, and media coverage intensifies?

Focus on what you can control. It’s natural to be nervous but it’s also crucial to tune out the noise, focus on the long term and stay the course.

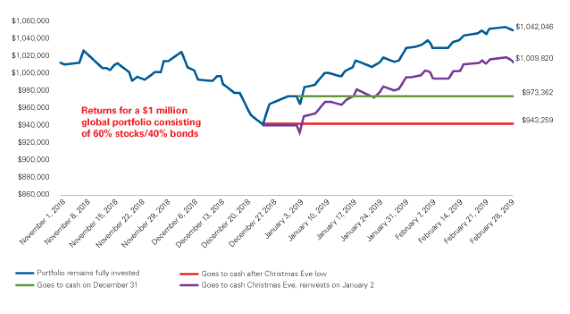

The graph below shows the trajectory of a portfolio based on four different investment decisions taken at the end of December 2018 when the market experienced a downturn.

It’s an important lesson in investor behaviour.

Source: Vanguard US calculations, based on data from FactSet, as of February 28, 2019.

Although the portfolio would have lost 5.7% since 1 November 2018, by staying the course and not selling at the market low, investors who remained in their asset allocation ended up gaining back 4.2% in just two months.

If the investor cashed out in December and then reinvests just a few days later, the value of their portfolio is still not as high as if they had remained.

Cashing out in December would mean the portfolio is nearly $100,000 less than what it could have been by February 2019.

By not sticking to your financial plan and losing sight of your goals when markets are volatile and emotions begin to dominate decision-making, you are potentially forfeiting not only the opportunity to regain and increase portfolio value, but also what is likely years of hard work and patience.

Emotionally reacting to market noise might be difficult to avoid but the downsides of succumbing to it should be carefully considered before you cash out or change investment tack.

It’s also always a good idea to consult your financial adviser in times of market downturn for both reassurance and perhaps, rebalancing.

As the humble Vanguard adage goes, “stay the course” in good times and bad. It cannot insure you from adverse market movements, but by having a diversified portfolio it does position you to ride out market storms and not be blown off the course you set in your financial plan.

Please contact us on Phone (03) 9974 3000 if you seek further discussion on this topic.

Written by Robin Bowerman, Head of Corporate Affairs at Vanguard.

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2020 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.