-

Are you headingWe are here to help.ABOUT USin the rightfinancial direction?

Are you headingWe are here to help.ABOUT USin the rightfinancial direction?

With you along the way

At Amazon Financial we work with you along the way on life’s journey. Whether you are getting married, starting a family, embarking on the trip of a lifetime or planning to enjoy your years after work, we can help.

It all starts with understanding exactly what it is you want to achieve. We will then create your financial plan to help you get there.

We can help you with ...

Superannuation

At Amazon Financial Advice, we can help you assess your current superannuation situation, and draw on our experience to make a recommendation to help you see your super grow.

Moving between jobs can be stressful, and there is often enough on your plate already without stopping to consider what might happen to your superannuation in this process. As a result, many of us end up with a variety of different super funds, each of which has fees associated with it. At Amazon Financial Advice, we can help you consolidate these funds into one account and take control of your super.

For most people, superannuation will provide the main source of income in retirement. Getting the right advice about your super can establish the kind of lifestyle and income which will be available to you to enjoy for the rest of your life.

To find out other simple tips to make the most of your money, please contact Amazon Financial, Financial Planners in Hoppers Crossing on Phone (03) 9974 3000.

Superannuation

Superannuation is a way to save for your retirement. You build up super while you are working to make sure you can have a comfortable retirement.

Read More....

Superannuation

At Amazon Financial Advice, we can help you assess your current superannuation situation, and draw on our experience to make a recommendation to help you see your super grow.

Moving between jobs can be stressful, and there is often enough on your plate already without stopping to consider what might happen to your superannuation in this process. As a result, many of us end up with a variety of different super funds, each of which has fees associated with it. At Amazon Financial Advice, we can help you consolidate these funds into one account and take control of your super.

For most people, superannuation will provide the main source of income in retirement. Getting the right advice about your super can establish the kind of lifestyle and income which will be available to you to enjoy for the rest of your life.

To find out other simple tips to make the most of your money, please contact Amazon Financial, Financial Planners in Hoppers Crossing on Phone (03) 9974 3000.

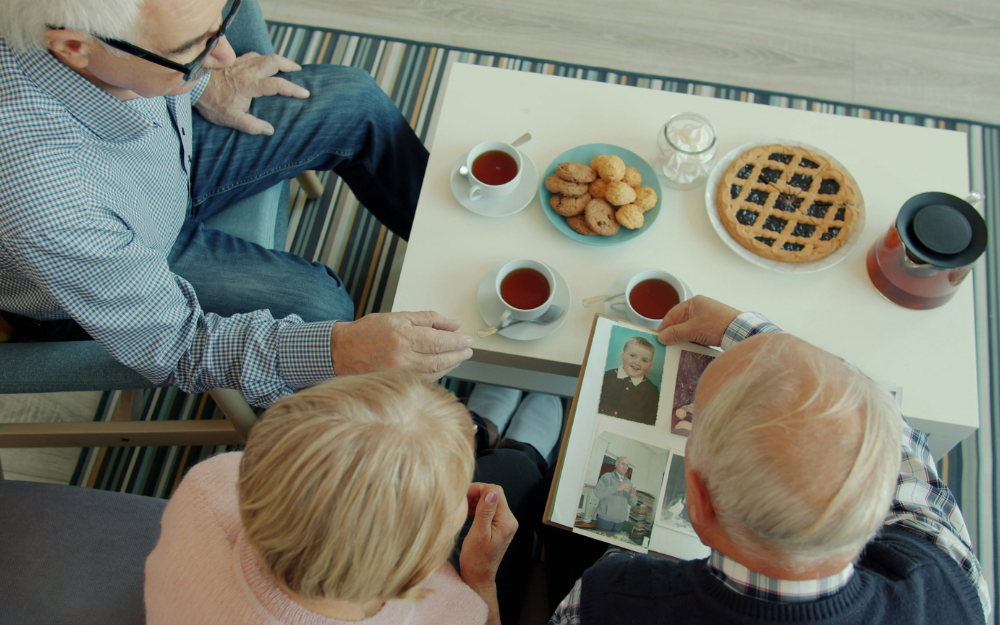

Retirement Planning

Easing into retirement

Retirement should be one of the most exciting times of your life: a time when you get to fulfil all the ambitions your busy working life kept getting in the way of.

You might plan to see more of the world or spend more time with your family. Perhaps you want to volunteer for the community or learn a new language. Whatever your retirement goals are, Amazon Financial can work with you to give you the best chance of doing exactly what you’ve always wanted to.

Why it’s never too late for advice

Amazon Financial can help you plan for retirement, no matter when you decide to stop work.

While there’s no substitute for early advice when it comes to planning a successful retirement, it’s never too late to get the advice you need.

In fact, there are some real benefits to getting financial advice just before you plan to leave the workforce.

For instance, with the help from Amazon Financial you’ll be well placed to set realistic and achievable goals to help you live the retirement you want.

We’ll also be able to help you predict what kind of income you’ll need and how close to achieving that income you are.

Amazon Financial can also help you add protection to your investments, which means you’ll have confidence of achieving your goals no matter what happens to markets.

So even if you’re close to retirement, you’ll always have options available to you when working with Amazon Financial to make the most of your situation:

- You might decide to work a little longer than you’d originally planned. That way you can delay reducing your super and maximise your earnings.

- You could be eligible to take advantage of co-contribution laws and salary sacrificing arrangements that boost your super earnings and reduce your tax burden.

- You may be able to take out a transition to retirement pension (TRP) to supplement a reduced income.

- If you can wait until you turn 60 before drawing on your super when all benefits become tax free, you might be able to make the most of the tax advantage super offers.

Amazon Financial can help you work out an effective retirement strategy no matter whether you plan to stop working tomorrow or in 10 years.

Please contact us on Phone (03) 9974 3000 to discuss your retirement.

Retirement Planning

Retirement may seem like a long way off but putting money into super now is still a tax effective way to invest your money. You also can benefit from the effects of compounding returns.

Read More ....

Retirement Planning

We all have different ideas of what the second half of our lives looks like and that’s why planning for your retirement is so important.

Why is retirement planning important?

We are living longer and for most of us compulsory superannuation payments or the Age Pension alone won’t be enough to help us achieve the retirement lifestyle we’re dreaming about.

Putting a long-term financial plan in place will provide you with the comfort of knowing that you can do all those things that you dreamed of and that your financial future is under control.

How we can help

Amazon Financial Financial Advisers can help you work out how much money you have now, how much you might have in the future and where it is coming from.

We will help you:

- Identify your retirement goals

- Review your income and cashflow requirements

- Identify what assets (house, savings, investments) you have and how much they are worth

- Assess how much super you have and when you can access it

- Find ways to grow your retirement income

- Put plans in place to make your money last in retirement

- Determine when you can apply for the age pension and whether you are likely to be eligible.

- Review your estate planning

How much money do I need to retire comfortably?

This is the magic question and how much money you need in your retirement nest egg will depend entirely on how you want to live in retirement.

According to the Association of Superannuation Funds of Australia’s Retirement Standard 2015, to have a ‘comfortable’ retirement, single people will need $545,000 in retirement savings, and couples will need $640,000.

The Standard is updated four times a year to take into consideration the rising price of items like food and utility bills, as well as changing lifestyle expectations and spending habits.

The Standard includes the cost of things such as health, communication, clothing, travel and household goods.

To see the latest Standard click here

Please contact one of our qualified Financial Advisers at Amazon Financial on Phone (03) 9974 3000 to discuss your retirement planning needs.

Wealth Protection

Many people don’t stop to consider what might happen financially to those they leave behind if they die. Mortgages and other future needs still have to be paid, and life insurance provides a lump sum payment to your loved ones to help ease this financial burden.

Income protection insurance provides you with a monthly income protection payment of up to 75% of your earnings if you’re unable to work due to sickness or injury. It can help cover your current living costs, such as mortgages, school fees and car repayments.

Critical illness insurance pays a lump sum that lightens the financial load of a serious illness, so you can concentrate on getting better.

In the unfortunate circumstance that you become totally and permanently disabled and are no longer able to work, TPD insurance provides you with a lump sum payment which can help pay medical costs and other debts, or make alterations to your home to help you adjust to your disability.

Simply contact Amazon Financial, or call Phone (03) 9974 3000 to find out how you can help take care of your family’s future.

Wealth Protection

Insurance is the foundation of all financial plans. We can help you evaluate the risks and come up with the right insurance solution for you and your family.

Read More ....

Wealth Protection

Many people don’t stop to consider what might happen financially to those they leave behind if they die. Mortgages and other future needs still have to be paid, and life insurance provides a lump sum payment to your loved ones to help ease this financial burden.

Income protection insurance provides you with a monthly income protection payment of up to 75% of your earnings if you’re unable to work due to sickness or injury. It can help cover your current living costs, such as mortgages, school fees and car repayments.

Critical illness insurance pays a lump sum that lightens the financial load of a serious illness, so you can concentrate on getting better.

In the unfortunate circumstance that you become totally and permanently disabled and are no longer able to work, TPD insurance provides you with a lump sum payment which can help pay medical costs and other debts, or make alterations to your home to help you adjust to your disability.

Simply contact Amazon Financial, or call Phone (03) 9974 3000 to find out how you can help take care of your family’s future.

Why Choose Us?

Exceptional Personal Service

Our focus is on listening, understanding, and caring about your concerns and providing you with an individual level of service.

Ongoing Support

Our friendly support team will support you throughout your journey with us and answer any questions you have along the way.

Knowledge and Experience

Our Financial Advisers are highly qualified and have the knowledge and experience necessary to focus on all your important financial matters.

A Holistic Approach

We want to understand exactly what you want to achieve in life and provide you with strategies to guide you towards your goals.

Keep You On Track

We will keep you accountable along the way because we want you to stay on track to achieve your goals.

Ease and Convenience

Deal with one company for your superannuation, investment, debt management, insurance and estate planning needs.

Meet Our Team

Jake White

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Jake White

Co-Founder and Financial Planner

Jake White

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English. Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Jane Brown

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Jane Brown

Financial Planner

Jane Brown

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Chris Red

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Chris Red

Practice Manager

Chris Red

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Ella Green

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Ella Green

Client Services Manager

Ella Green

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.It is a long established fact that a reader will be distracted by the readable content of a page when looking at its layout. The point of using Lorem Ipsum is that it has a more-or-less normal distribution of letters, as opposed to using 'Content here, content here', making it look like readable English.

Many desktop publishing packages and web page editors now use Lorem Ipsum as their default model text, and a search for 'lorem ipsum' will uncover many web sites still in their infancy. Various versions have evolved over the years, sometimes by accident, sometimes on purpose (injected humour and the like).

What Our Clients Say

Latest News

Getting on top of your finances is one of the most common new year’s resolutions.…

We plan for holidays, home renovations, and retirement but we’re less likely to plan for…

Self-managed superannuation fund (SMSF) trustees always have a lot on their to-do lists but the…

A sudden death can place financial stress on those who depend on you. If this…